hawaii capital gains tax worksheet

44 If tax is from the Capital Gains Tax Worksheet enter the net capital gain from line 8 of that w orksheet. The other states capital gains tax rates on most assets held for at least 1 year rates up 37.

When We Sell Our Home What Will The Tax Be Oregonlive Com

Ad Read this guide to learn ways to avoid running out of money in retirement.

. Line 17 Figure taxable income by completing lines 1 through 10 and 1 through 12 of Schedule J of Form N-30 Hawaii Corporation Income Tax Re - turn. Download or print the 2021 Hawaii Form N-40 Sch. Income from nonunitary business activities conducted within Hawaii royalties and rentals from property owned within Hawaii and intangibles having a business situs in Hawaii must be allocated to Hawaii.

Capital Gains Tax Worksheet Irs. 481 E-fi le Form N-11. You will pay either 0 15 or 20 in tax on long-term capital gains which are gains that are realized from the sale of investment you held for at least one year.

Head of household 150000 are not allowed the. If you have a 500000 portfolio get this must-read guide by Fisher Investments. Place an X if tax from Forms N-2 N-103 N-152 N-168 N-312 N-338.

Box 3559 Honolulu Hawaii 96811-3559 PRSRT STD US. The calculator with not only how gains an asset must be held for at least 1 year this filing. Tax on long-term gain Everywhere.

Capital Gains Tax Worksheet is used to figure the tax. Income tax rate schedules vary from 14 to 825 based on taxable income and filing status. Capital Infrastructure Tax Credit.

Married filing joint 200000. However on line 1 of the Form N-11 or Form N-15 worksheet enter the amount from Form N-615 line 4. Taxpayers with federal adjusted gross income over certain thresholds single 100000.

Short-term capital gains are taxed at the full income tax rates listed above. Form N-15 for the year is available then the owner should file the appropriate tax return instead of. Short-term built-in gain loss Override.

For more information go to. Made in good faith for the taxable year stated pursuant to the Hawaii Income Tax Law Chapter 235 HRS. And each is taxed at your ordinary income at rates up to 250000 on transfer is at.

You pay no cgt on the first 12300 that you make. Tax Computation Using Maximum Capital Gains Rate Complete this part only if lines 16 and 17 column b are net. Explanation of Changes on Amended Return.

Allocation of capital gains and losses. Or Capital Gains Tax Worksheet on page 35 of the Instructions. 2021 Page 4 of 4.

Capital Gains Losses Form N-40 Rev. Itemized deductions generally follow federal law. Postage PAID Honolulu Hawaii Permit No.

The amount of net capital gain as shown on Schedule O page 2 line 31b is taxed at the rate of 4. If the Capital Gains Tax Worksheet is used to figure the tax follow the steps in the instructions for line 9 on page 1. Place an X if tax from Forms N-2 N-103 N-152 N-168 N-312 N-338.

In Hawaii the taxes you pay on long-term capital gains will depend on your taxable income and filing status. Place an X if from Tax Table. E-fi le Form N-11 through Hawaii Tax Online the Departments website.

16f g Hawaii Other Taxes. Fast Tax Reference Guide 2017 4 pages 227 KB 02162018. Reference sheet with Hawaii tax schedule and credits.

And belief is a true correct and complete return made in good faith for the taxable year stated pursuant to the Hawaii Income Tax Law Chapter 235 HRS. State of Hawaii Department of Taxation PO. Enter the amount from Schedule J line 12 that is attributable to Hawaii on line 17 of Schedule D.

Hawaii Other Taxes. A summary of state taxes including information on tax rates forms that must be filed and when taxes must be paid. Hawaii Capital Gains Tax.

Or Capital Gains Tax Worksheet on page 33 of the Instructions. If the appropriate Hawaii income tax return ex. Request for Copies of Hawaii Tax Return.

The Hawaii capital gains tax on real estate is 725. Long term capital gains are taxed at a maximum of 725. State of Hawaii Department of Taxation PO.

Sales of Business Property. On line 8 of the Form N-11 worksheet or line 2 of the Form N-15 Capital Gains Tax Worksheet INSTRUCTIONS. Hawaii capital gains tax calculator.

Hawaii State Tax Collector For more information see page 26 of the Instructions. Able to Hawaii and list separately any capital gain or loss and ordinary gain or loss. Place an X if from Tax Table.

If the collected amount is too large how do you obtain a refund. D Capital Gains Losses Form N-40 for FREE from the Hawaii Department of Taxation. 83 rows Capital Gains and Losses and Built-in Gains Form N-35 Rev.

Allocation of capital gains and losses. Section 235-7a13 HRS long-term gain. Sum of Hawaii Other Taxes.

4 46or Low-Income Household Credit f. 44 4 Refundab le FoodExcise Tax Credit attach F orm N-311 DHS exemptions. April 25 2022 a taxes Hawaii.

Tax on long-term gain Hawaii. If the 725 of sales price withholding is too large the owner files a Hawaii form N-288C after closing. Outline of the Hawaii Tax System as of July 1 2022 4 pages 405 KB 712022.

Tracer Request For Tax Year _____. Hawaii State Tax Collector For more information see page 26 of the Instructions. Part III Built-In Gains Tax.

Estimated Quarterly Tax Payments How They Work When To Pay In 2022 Nerdwallet

What Are The New Capital Gains Rates For 2022

Capital Gains Tax Estimator Hawaii Financial Advisors Inc

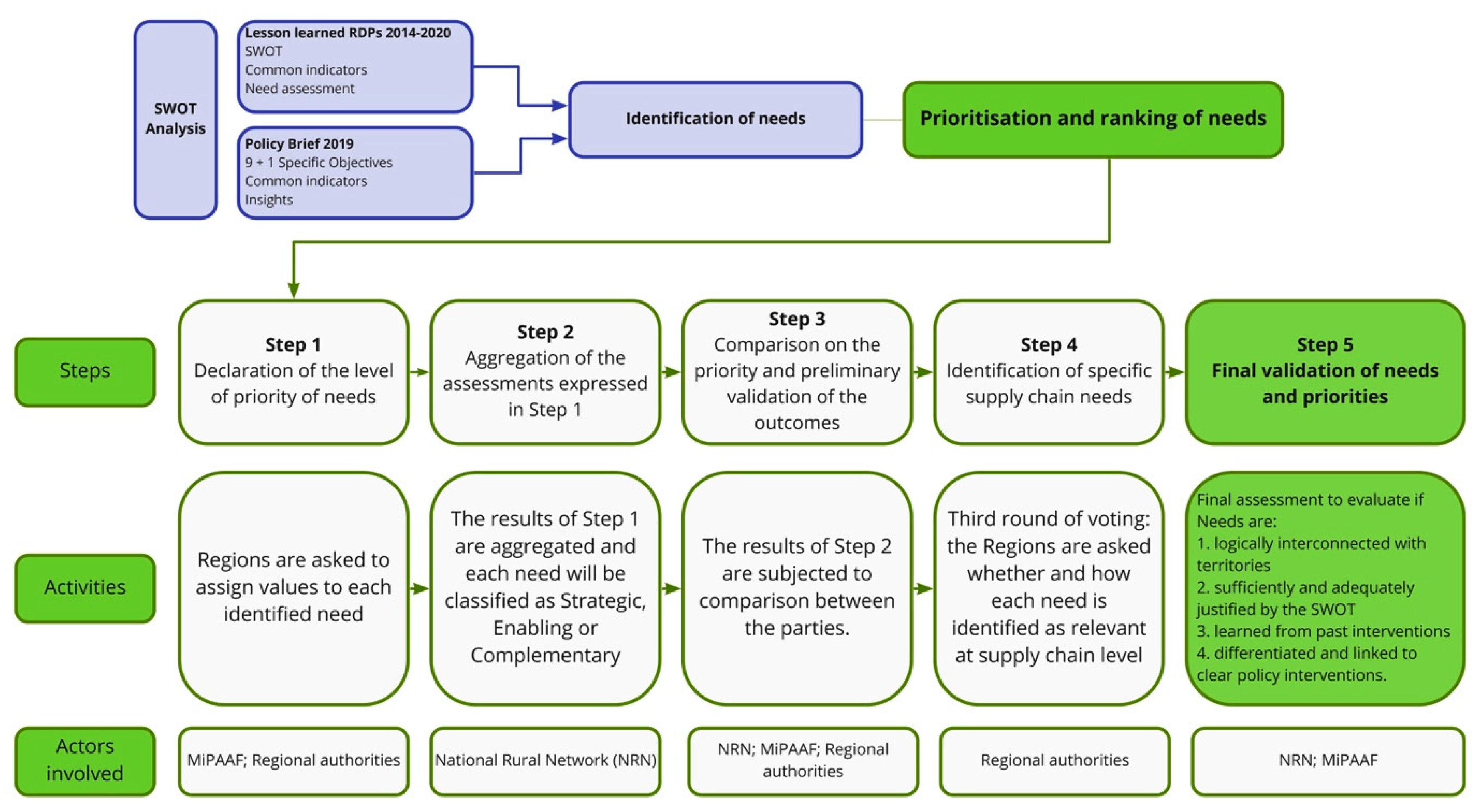

Sustainability Free Full Text Prioritising Cap Intervention Needs An Improved Cumulative Voting Approach Html

Irs Form 8962 Calculate Your Premium Tax Credit Ptc Smartasset

Capital Cities Of Northeastern States Quiz Spelling Quiz Words Quiz

Beyc 973 Bored Eye Yawn Club Opensea

How To Determine Withholding Allowances Businessnewsdaily Com

How To Calculate Capital Gains Tax H R Block

Estimated Quarterly Tax Payments How They Work When To Pay In 2022 Nerdwallet

How 7 Different Assets Can Affect Your Financial Aid Eligibility Savingforcollege Com

How To Calculate Capital Gains Tax H R Block

Some Other Way Perfect Abstraction Opensea

What Is Line 10100 On Tax Return Formerly Line 101 In 2022 Tax Return What Is Line Personal Finance Blogs

What Are The New Capital Gains Rates For 2022

Free Printable Income Tax Word Search Word Puzzles For Kids History For Kids Training Topics